ONTARIO, Calif., April 10, 2018 (GLOBE NEWSWIRE) — Kiwa Bio-Tech Products Group Corporation (KWBT) (“Kiwa Bio-Tech” or the “Company”), a leading manufacturer of biological fertilizers promoting eco-friendly agriculture and smart-soil technology, is pleased to announce the financial and operating results for the fiscal year ended December 31, 2017 that included earnings per share of $0.51.

Fiscal 2017

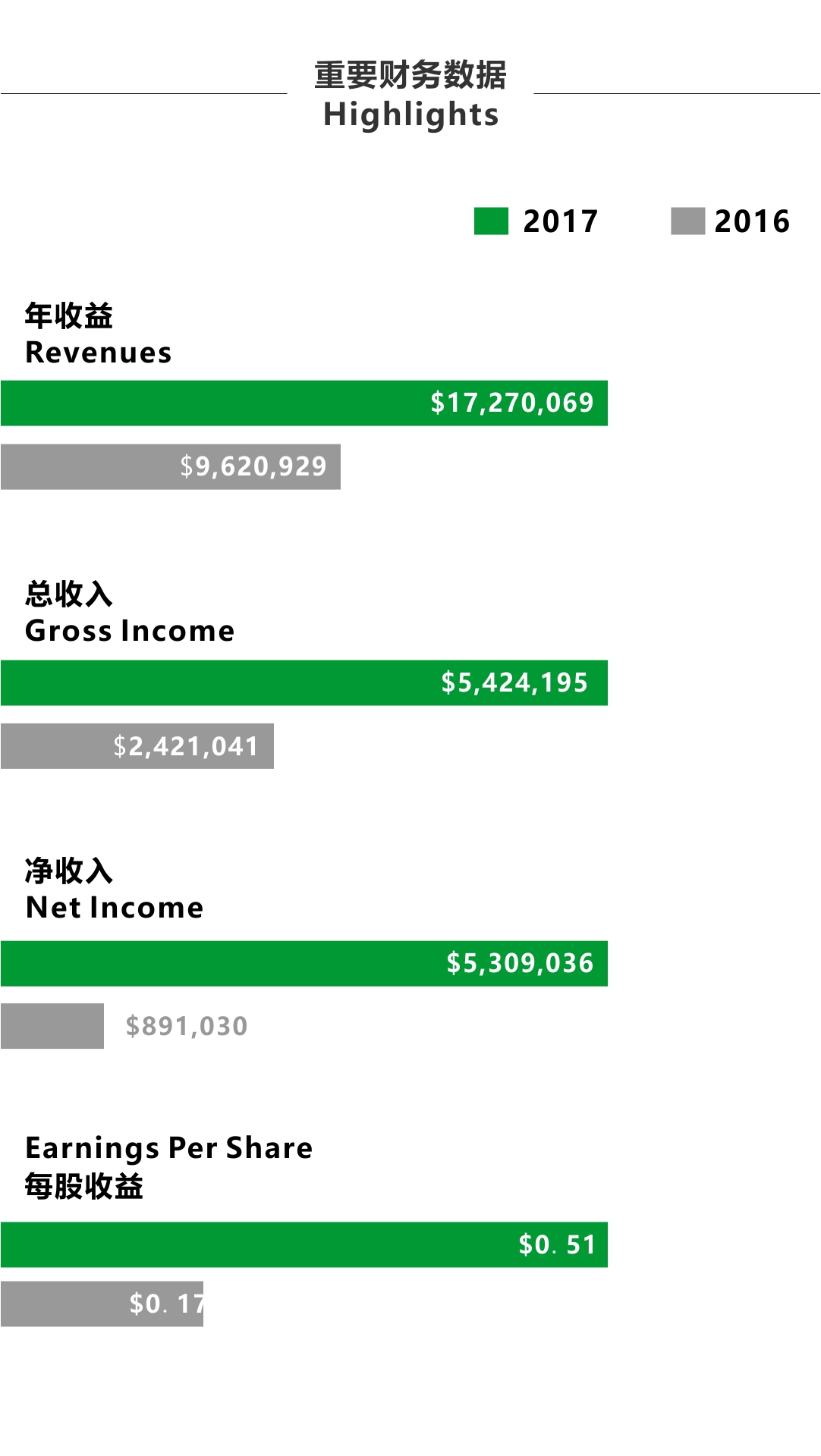

- Revenues of $17,270,069 up 80% compared to 2016 of $9,620,929.

- Gross Income of $5,424,195 up 124% compared to 2016 of $2,421,041.

- Net Income of $5,309,036 up 496% compared to 2016 of $891,030.

- Earnings Per Share $0.51, up 200% compared to 2016 of $0.17.

Highlights

- China ranks first in worldwide agricultural output. Although accounting for only 10 percent of arable land throughout the world, China produces food for 20 percent of the world population. Our goal is tied closely to the demand of safe food and green agriculture for the world largest population.

- In 2017, the Chinese Ministry of Agriculture has issued Circular No. 2017-02 to target zero growth in the use of chemical fertilizers.

- In February 2017, the Ministry of Agriculture of PRC has carried out measures to replace 20% of chemical fertilizers with organic fertilizers for fruits, teas, and vegetables by 2020, which created a 30-billion-dollar market for eco-friendly fertilizer products.

- In 2017, the PRC State Council issued statements to promote agricultural structural reform on accelerating the cultivation in the agricultural development.

- The company expanded its business operations to include soil restoration for farmland in China. The Kiwa smart-soil technology is already being supported by the government in China.

“We are pleased to report solid results for the fiscal year in which we achieved or surpassed all of our 2017 financial outlook metrics. Our results continue to validate the strength of our market positions. Over the past year, our brand continues to gain market share in China. As we enter 2018, our management team anticipates strong organic growth with gross revenues,” stated Yvonne Wang, Kiwa’s CEO.

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 31, 2017 | December 31, 2016 | |||

| ASSETS | ||||

| Current assets | ||||

| Cash and cash equivalents | $ | 1,083,539 | $ | 13,469 |

| Accounts receivable | 28,620 | 1,122,754 | ||

| Prepaid expenses | 2,474,272 | 1,417,554 | ||

| Rent deposits and other receivables | 44,423 | 38,897 | ||

| Advance to suppliers | 12,660,793 | 1,880,044 | ||

| Due from related parties – non-trade | 19,017 | – | ||

| Inventory | 2,745,991 | – | ||

| Deferred cost of goods sold | 16,726 | – | ||

| Total current assets | 19,073,381 | 4,472,718 | ||

| Property, plant and equipment – net | 90,500 | 55,319 | ||

| Rent deposits-non current | 72,631 | 34,519 | ||

| Due from related party – non-trade | – | 1,522,434 | ||

| Deposit for Long-Term Investment | 768,074 | – | ||

| Total non-current assets | 931,205 | 1,612,272 | ||

| Total assets | 20,004,586 | 6,084,990 | ||

| LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIENCY) | ||||

| Current liabilities | ||||

| Accounts payable | 1,800,614 | 1,073,094 | ||

| Advances from customers | 543,581 | – | ||

| Due to related parties | 320,199 | 261,259 | ||

| Convertible notes payable, net of discount of $1,977 at December 31, 2017 | 273,200 | 150,250 | ||

| Derivative liabilities | 247,933 | – | ||

| Notes payable | 360,000 | 360,000 | ||

| Salary payable | 291,401 | 1,154,921 | ||

| Income Taxes payable | 1,142,973 | 414,970 | ||

| Interest payable | 1,756,275 | 1,524,988 | ||

| Other payables and accruals | 2,108,873 | 924,875 | ||

| Deferred revenue | 28,620 | – | ||

| Current liabilities of discontinued operation | – | 4,464,685 | ||

| Total current liabilities | 8,873,669 | 10,329,042 | ||

| Convertible notes payable-non-current, net of discount of $ 384,799 at December 31, 2017 | 460,082 | – | ||

| Total liabilities | 9,333,751 | 10,329,042 | ||

| STOCKHOLDERS’ EQUITY (DEFICIENCY) | ||||

| Preferred stock – $0.001 par value, Authorized 20,000,000 shares. Series A – Issued and outstanding 500,000 and 500,000 shares at December 31, 2017 and December 31, 2016, respectively; Series B – Issued and outstanding 811,148 and 0 shares at December 31, 2017 and December 31, 2016, respectively. | 1,311 | 500 | ||

| Common stock – $0.001 per value. Authorized 100,000,000 shares. Issued and outstanding 15,202,965 and 8,728,981 shares at December 31, 2017 and 2016, respectively. | 15,203 | 8,729 | ||

| Additional paid-in capital | 24,455,291 | 15,234,878 | ||

| Statutory Reserve | 458,334 | 127,473 | ||

| Accumulated deficit | (14,583,080) | (19,561,255) | ||

| Accumulated other comprehensive gain (loss) | 323,776 | (54,377 | ||

| Total stockholders’ equity (deficiency) | 10,670,835 | (4,244,052) | ||

| Total liabilities and stockholder’s equity (deficiency) | $ | 20,004,586 | $ | 6,084,990 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

Years Ended December 31 | ||||

2017 | 2016 | |||

| Revenue | $ | 17,270,069 | $ | 9,620,929 |

| Cost of goods sold | (11,845,874) | (7,199,888) | ||

| Gross profit | 5,424,195 | 2,421,041 | ||

| Operating expenses | ||||

| Research and development expenses | 147,992 | 149,176 | ||

| Selling expenses | 483,045 | 530,346 | ||

| General and administrative expenses | 2,997,027 | 868,793 | ||

| Total operating expenses | 3,628,064 | 1,548,315 | ||

| Operating Income | 1,796,131 | 872,726 | ||

| Other income/(expense), net | ||||

| Trademark license income – related party | – | 786,329 | ||

| Change in fair value of derivative liabilities | 321,851 | |||

| Interest expense | (524,333 ) | (190,552 ) | ||

| Other income/(expense) | 382,126 | (2,091 ) | ||

| Exchange loss | (58,757 ) | – | ||

| Total other income/(expense), net | 120,887 | 593,686 | ||

| Income from continuing operations before income taxes | 1,917,018 | 1,466,412 | ||

| Income tax | (1,103,315 ) | (424,911 ) | ||

| Income from continuing operations | 813,703 | 1,041,501 | ||

| Discontinued operations: | ||||

| Loss from discontinued operations, net of taxes | (16,849) | (150,471 ) | ||

| Gain on disposal of discontinued operations, net of taxes | 4,512,182 | – | ||

| Income (loss) from discontinued operations, net of taxes | 4,495,333 | (150,471 ) | ||

| Net income | 5,309,036 | 891,030 | ||

| Other comprehensive income | ||||

| Foreign currency translation adjustment | 378,153 | 214,602 | ||

| Total comprehensive income | 5,687,189 | 1,105,632 | ||

| Earnings per share – Basic: | ||||

| Income from continuing operations | 0.08 | 0.20 | ||

| Income from discontinued operations | 0.43 | (0.03 | ||

| Net income | 0.51 | 0.17 | ||

| Earnings per share – Diluted: | ||||

| Income from continuing operations | 0.07 | 0.10 | ||

| Income from discontinued operations | 0.36 | (0.01 ) | ||

| Net income | 0.43 | 0.09 | ||

| Weighted average number of common shares outstanding – basic | 10,471,725 | 5,162,394 | ||

| Weighted average number of common shares outstanding – diluted | $ | 12,541,946 | $ | 10,584,848 |

OUTLOOK FOR 2018

Management of the Corporation (“Management”) has provided guidance on 2018 operating results in the Management’s Discussion & Analysis (“MD&A”) for the year ended December 31, 2017. The outlook is provided to assist analysts and shareholders in formalizing their respective views on 2018. These measures are subject to change.

DIVIDEND

The Company did not pay a dividend in 2017 and it is not planned for in 2018. It is anticipated by the company that current revenues will be utilized for corporate expansion of additional manufacturing facilities and for the opening of additional retail outlet distribution stores in China.

FINANCIAL REPORT

This release includes, by reference, the 2017 financial reports, including the audited consolidated financial statements and the Management’s Discussion & Analysis (“MD&A”) of the Corporation.

For a copy of our 2017 financial results, including the MD&A and the audited consolidated financial statements, please visit our website at www.kiwabiotech.com

About Kiwa Bio-Tech Products Group Corp.

Kiwa Bio-Tech Products Group Corp. (KWBT) is a publicly traded company with corporate headquarters in the United States. The company develops, manufactures, markets and distributes innovative and environmentally safe bio-technological products for agriculture. Kiwa’s focus is to positively impact the environment by reducing the amount of chemicals that are being used by agricultural growers in China.

Kiwa Bio-Tech Products Group corp. products are covered by patent protection and are designed to enhance the quality of human life by increasing the value and productivity of agricultural crops.

For more information on Kiwa Bio-Tech Products Group Corp. or its bio-fertilizer products and smart soil remediation technology, please refer to the Company’s website at www.kiwabiotech.com or the Company filings with the United States Securities and Exchange Commission at www.sec.gov.

Forward-Looking Statements

This press release contains information that constitutes forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements involve risk and uncertainties that could cause actual results to differ materially from any future results described by the forward-looking statements. Risk factors that could contribute to such differences include those matters more fully disclosed in the Company’s reports filed with the U.S. Securities and Exchange Commission. The forward-looking information provided herein represents the Company’s estimates as of the date of the press release, and subsequent events and developments may cause the Company’s estimates to change. The Company’s actual results may differ materially from those anticipated in the forward-looking statements depending on a number of risk factors including, but not limited to, the following: general economic, business and environment conditions, development, shipment, market acceptance, additional competition from existing and new competitors, changes in technology, the execution of its ten-year growth plan, the foreign exchange risk amid the unexpected announcements by the PRC government and various other factors beyond the Company’s control. Kiwa Bio-Tech Products Group Corp. specifically disclaims any obligation to update the forward-looking information in the future. Therefore, this forward-looking information should not be relied upon as representing the Company’s estimates of its future financial performance as of any date subsequent to the date of this press release

Contact:

Kiwa Bio-Tech Products Group Corporation

Molly Han

Investor & Media Relations

Tel: 909-456-8828

molly@kiwabiotech.com

[This is a correction of the Press Release disseminated by the Company on April 10, 2018]